Apple Shareholders Meeting: A Comprehensive Guide for Investors

Attending or simply staying informed about the **Apple Shareholders Meeting** is crucial for any investor in the tech giant. This annual event provides a platform for shareholders to engage with Apple’s leadership, understand the company’s performance, and vote on important corporate matters. This comprehensive guide delves into every aspect of the Apple Shareholders Meeting, equipping you with the knowledge and insights you need to navigate this significant event. We’ll explore the meeting’s purpose, key procedures, and how it affects your investment. We aim to provide a more insightful and useful guide than anything else available online.

What is the Apple Shareholders Meeting?

The **Apple Shareholders Meeting** is an annual gathering where Apple Inc.’s leadership presents the company’s performance, strategic direction, and addresses shareholder concerns. It’s a formal event mandated by corporate governance principles, providing transparency and accountability to investors. Unlike quarterly earnings calls, this meeting offers a broader, more holistic view of the company’s long-term vision. The meeting serves as a vital link between the company and its owners, fostering dialogue and ensuring that shareholder voices are heard.

The Historical Significance

Apple’s shareholders meetings have evolved significantly over the years. Early meetings were often smaller and more focused on immediate financial performance. As Apple grew into a global powerhouse, the meetings expanded in scope, addressing broader strategic issues like product innovation, environmental responsibility, and social impact. The legacy of Steve Jobs, known for his captivating presentations, has undoubtedly shaped the aura surrounding these events. The meetings are now carefully orchestrated events, blending financial updates with product showcases and forward-looking statements. They are also opportunities to hear from current CEO Tim Cook, who delivers the company’s vision and strategic direction.

Key Objectives of the Meeting

The **Apple Shareholders Meeting** serves several critical objectives:

* **Performance Review:** Presenting the company’s financial and operational performance over the past year.

* **Strategic Outlook:** Outlining the company’s strategic priorities and future plans.

* **Shareholder Voting:** Conducting votes on proposals related to corporate governance, executive compensation, and other important matters.

* **Q&A Session:** Providing an opportunity for shareholders to ask questions of the company’s leadership.

* **Engagement:** Fostering dialogue and building relationships between the company and its shareholders.

Why is it Important for Shareholders?

Attending or following the **Apple Shareholders Meeting** is paramount for shareholders because it offers several advantages:

* **Informed Decision-Making:** Gain insights into the company’s performance and strategic direction, enabling more informed investment decisions.

* **Voice Your Opinion:** Exercise your right to vote on important corporate matters.

* **Hold Leadership Accountable:** Ask questions and raise concerns directly with Apple’s leadership.

* **Network with Other Investors:** Connect with other shareholders and gain diverse perspectives.

* **Understand Future Plans:** The meeting provides clarity on future product roadmaps and strategic initiatives.

Understanding Apple’s Corporate Governance Structure

To fully appreciate the significance of the Apple Shareholders Meeting, it’s essential to understand Apple’s corporate governance structure. This structure defines the roles, responsibilities, and relationships between the company’s various stakeholders, including the board of directors, executive management, and shareholders. Understanding this framework empowers shareholders to actively participate in the meeting and hold leadership accountable.

The Board of Directors

The Board of Directors is the governing body of Apple, responsible for overseeing the company’s management and ensuring that it acts in the best interests of its shareholders. The board comprises independent directors with diverse expertise in technology, finance, and business. They provide guidance and oversight on strategic decisions, risk management, and corporate governance practices.

Executive Management

Executive management, led by the CEO, is responsible for the day-to-day operations of Apple. They develop and implement the company’s strategic plans, manage its resources, and drive its financial performance. The executive team works closely with the Board of Directors to ensure alignment between the company’s strategic objectives and its operational execution.

Shareholder Rights and Responsibilities

Shareholders have certain rights and responsibilities under corporate law. These include the right to vote on important corporate matters, the right to receive information about the company’s financial performance, and the right to hold directors and officers accountable for their actions. Shareholders also have a responsibility to act in good faith and to exercise their rights in a manner that promotes the long-term interests of the company.

Preparing for the Apple Shareholders Meeting

To make the most of the **Apple Shareholders Meeting**, it’s crucial to prepare in advance. This involves understanding the agenda, reviewing relevant materials, and formulating questions you want to ask the company’s leadership.

Reviewing the Proxy Statement

The proxy statement is a document that Apple sends to its shareholders before the meeting. It contains detailed information about the agenda items, including proposals for shareholder voting, executive compensation, and director nominations. Reviewing the proxy statement carefully is essential for understanding the issues at stake and making informed voting decisions.

Understanding the Agenda

The agenda for the **Apple Shareholders Meeting** typically includes the following items:

* **Election of Directors:** Shareholders vote to elect members of the Board of Directors.

* **Executive Compensation:** Shareholders vote on the compensation packages for Apple’s executive officers.

* **Shareholder Proposals:** Shareholders vote on proposals submitted by other shareholders on various topics, such as corporate governance, environmental responsibility, and social issues.

* **Q&A Session:** Shareholders have the opportunity to ask questions of Apple’s leadership.

Formulating Questions

Preparing thoughtful questions to ask during the Q&A session is a great way to engage with Apple’s leadership and gain deeper insights into the company’s strategy. Consider asking questions about the company’s future plans, its competitive landscape, or its approach to addressing social and environmental challenges. It is often a good idea to review previous Apple Shareholder Meeting transcripts to see what questions have been asked, and what questions have not been asked, in the past. This can help you formulate your own unique questions.

Attending the Apple Shareholders Meeting

Attending the **Apple Shareholders Meeting**, either in person or virtually, can be a valuable experience. It provides an opportunity to witness the event firsthand, engage with Apple’s leadership, and connect with other shareholders.

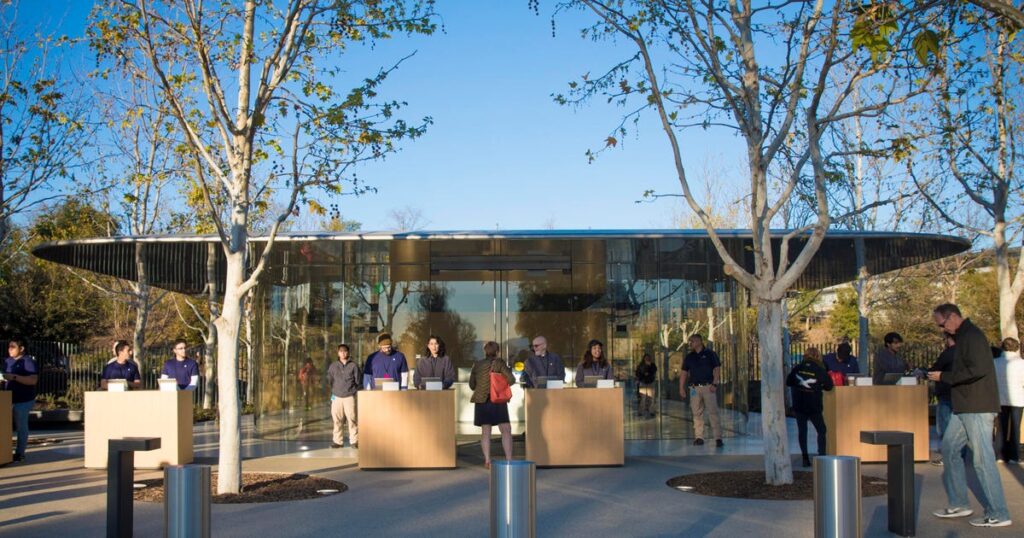

Registration and Logistics

To attend the meeting, you’ll need to register in advance, typically through Apple’s investor relations website. The registration process may require you to provide proof of share ownership. Be sure to check the meeting’s location and time and make any necessary travel arrangements.

What to Expect During the Meeting

The meeting typically begins with a presentation by Apple’s CEO, followed by presentations from other members of the executive team. The presentations cover the company’s financial performance, strategic priorities, and product innovations. After the presentations, there’s a Q&A session where shareholders can ask questions of the company’s leadership. Finally, shareholders vote on the agenda items.

Engaging with Apple’s Leadership

The Q&A session is your opportunity to engage directly with Apple’s leadership. Be prepared to ask thoughtful and relevant questions. It is important to remain respectful and professional in your interactions. Remember, the goal is to gain insights and contribute to a productive dialogue.

Key Topics Discussed at Apple Shareholders Meetings

**Apple Shareholders Meetings** cover a wide range of topics, reflecting the company’s diverse interests and priorities. Some of the key topics that are frequently discussed include:

* **Financial Performance:** Apple’s financial results, including revenue, earnings, and cash flow.

* **Product Innovation:** New product launches, technological advancements, and future product roadmaps.

* **Strategic Initiatives:** Apple’s strategic priorities, such as expanding into new markets, developing new technologies, and enhancing its brand.

* **Corporate Governance:** Issues related to corporate governance, such as executive compensation, director nominations, and shareholder rights.

* **Environmental Responsibility:** Apple’s efforts to reduce its environmental impact and promote sustainability.

* **Social Impact:** Apple’s initiatives to address social issues, such as education, diversity, and human rights.

Impact of Apple Vision Pro on Future Strategy

One area of considerable discussion at recent and future meetings is the impact of the Apple Vision Pro. While still a relatively new product, its potential to influence Apple’s future strategy in areas like augmented reality, enterprise solutions, and even its core consumer electronics lines is significant. Shareholders will likely be keen to hear about early adoption rates, developer interest, and Apple’s long-term vision for this technology.

The Voting Process: How Shareholders Influence Apple’s Direction

The voting process at the **Apple Shareholders Meeting** is a crucial mechanism through which shareholders can influence the company’s direction. Each share of Apple stock typically entitles the holder to one vote on each agenda item. This collective power allows shareholders to shape corporate governance, executive compensation, and other critical aspects of the company’s operations.

Understanding the Different Types of Proposals

There are two main types of proposals that shareholders vote on:

* **Management Proposals:** These are proposals submitted by Apple’s management team, typically related to routine matters such as the election of directors and the ratification of the company’s auditors.

* **Shareholder Proposals:** These are proposals submitted by other shareholders, often related to corporate governance, environmental responsibility, or social issues. Shareholder proposals can be binding or non-binding, depending on the specific proposal and applicable laws.

How to Cast Your Vote

Shareholders can cast their votes in several ways:

* **In Person:** Attending the meeting and voting in person.

* **By Proxy:** Submitting a proxy card authorizing another person to vote on their behalf.

* **Online:** Voting online through Apple’s investor relations website.

The Impact of Shareholder Voting

Shareholder voting can have a significant impact on Apple’s direction. While management proposals are typically approved, shareholder proposals can influence the company’s policies and practices. For example, a successful shareholder proposal could lead to changes in executive compensation, increased transparency, or a greater focus on environmental sustainability. Even if a shareholder proposal doesn’t pass, it can still raise awareness of important issues and prompt the company to take action.

The Role of Institutional Investors

Institutional investors, such as mutual funds, pension funds, and hedge funds, hold a significant portion of Apple’s outstanding shares. As a result, they wield considerable influence over the company’s direction. Institutional investors typically have dedicated teams that analyze corporate governance issues and make voting recommendations on behalf of their clients. Their voting decisions can significantly impact the outcome of shareholder votes.

Proxy Advisory Firms

Proxy advisory firms, such as Institutional Shareholder Services (ISS) and Glass Lewis, provide research and recommendations to institutional investors on how to vote on proxy proposals. These firms analyze the proposals, assess their potential impact on shareholder value, and make recommendations based on their analysis. Institutional investors often rely on the recommendations of proxy advisory firms when making their voting decisions.

Analyzing the Impact of Apple Shareholders Meeting on Stock Price

The **Apple Shareholders Meeting** can have a noticeable impact on the company’s stock price, although this impact is often short-term and influenced by a variety of factors. The information shared, the tone of the meeting, and the overall sentiment expressed by management can all contribute to market reactions.

Positive Signals and Stock Performance

If the meeting conveys a strong sense of confidence in Apple’s future, highlights positive financial results, and unveils innovative product roadmaps, the stock price may experience a boost. Clear communication and a transparent approach to addressing shareholder concerns can also instill investor confidence.

Negative Signals and Stock Performance

Conversely, if the meeting reveals disappointing financial results, raises concerns about strategic direction, or lacks transparency in addressing shareholder questions, the stock price may decline. Uncertainty or ambiguity in management’s statements can also trigger negative market reactions.

Long-Term vs. Short-Term Effects

While the immediate impact of the **Apple Shareholders Meeting** on the stock price can be significant, the long-term effects are typically more muted. The stock price is ultimately driven by the company’s underlying financial performance, competitive landscape, and overall market conditions. The meeting serves as a snapshot in time, providing insights into the company’s current state and future prospects, but it’s just one factor among many that influence the stock price over the long term.

Apple Shareholders Meeting: What to Expect in 2025

Looking ahead to the **Apple Shareholders Meeting** in 2025, several key themes are likely to dominate the discussion:

* **Artificial Intelligence (AI):** Apple’s strategy for integrating AI into its products and services will be a major focus.

* **Supply Chain Resilience:** Addressing the challenges of global supply chain disruptions and ensuring the availability of components.

* **Sustainability Initiatives:** Progress on Apple’s environmental goals and its commitment to reducing its carbon footprint.

* **New Product Categories:** Potential expansion into new product categories, such as augmented reality (AR) and virtual reality (VR).

* **Regulatory Landscape:** Navigating the evolving regulatory landscape, including antitrust concerns and privacy regulations.

Potential Shareholder Proposals

Shareholders may submit proposals on a variety of topics, such as:

* **Board Diversity:** Increasing the representation of women and minorities on the Board of Directors.

* **Climate Change:** Setting more ambitious targets for reducing greenhouse gas emissions.

* **Human Rights:** Strengthening Apple’s policies on human rights in its supply chain.

Q&A: Your Questions Answered About the Apple Shareholders Meeting

Here are some frequently asked questions about the **Apple Shareholders Meeting**:

1. **How do I become eligible to attend the Apple Shareholders Meeting?**

*You must be a registered shareholder of Apple Inc. as of the record date, which is typically a few weeks before the meeting. Check Apple’s investor relations website for specific details.*

2. **Can I attend the meeting virtually?**

*Yes, Apple typically offers a virtual option for shareholders to attend the meeting online.*

3. **Where can I find the proxy statement for the meeting?**

*The proxy statement is available on Apple’s investor relations website.*

4. **What is a proxy card, and how do I use it?**

*A proxy card is a document that allows you to authorize another person to vote on your behalf. You can complete and submit the proxy card online or by mail.*

5. **How do I submit a question for the Q&A session?**

*Apple typically provides instructions on how to submit questions online during the meeting.*

6. **What is the difference between a management proposal and a shareholder proposal?**

*Management proposals are submitted by Apple’s management team, while shareholder proposals are submitted by other shareholders.*

7. **How can I track the results of the shareholder votes?**

*Apple typically publishes the results of the shareholder votes on its investor relations website after the meeting.*

8. **What role do proxy advisory firms play in the voting process?**

*Proxy advisory firms provide research and recommendations to institutional investors on how to vote on proxy proposals.*

9. **How does the Apple Shareholders Meeting impact the company’s stock price?**

*The meeting can have a short-term impact on the stock price, but the long-term effects are typically more muted.*

10. **Where can I find transcripts or recordings of past Apple Shareholders Meetings?**

*Apple’s investor relations website often provides access to past meeting materials, including transcripts or recordings.*

Conclusion: Staying Informed and Engaged with Apple

The **Apple Shareholders Meeting** is a critical event for investors, providing a platform for engagement, transparency, and accountability. By understanding the meeting’s purpose, preparing in advance, and actively participating in the voting process, shareholders can play a meaningful role in shaping Apple’s future. Staying informed about the issues discussed at the meeting and analyzing their potential impact on the company’s performance is essential for making sound investment decisions. We hope this comprehensive guide has provided you with the knowledge and insights you need to navigate the **Apple Shareholders Meeting** with confidence. Now, explore Apple’s Investor Relations page for more detailed information, including past meeting transcripts, upcoming meeting dates, and proxy statements. Share your thoughts and experiences attending or following an Apple Shareholders Meeting in the comments below!